How much should our law firm bill for paralegal work?

As part of a court ruling in Missouri v. Jenkins, the Supreme Court held that legal fees can include paralegal charges at a rate that relates to the market rather than what they’re actually being paid by the attorney[1]. To figure out what rate your law firm should be charging, it’s important to consider what the going market rate for paralegal billable hours is.

It’s important to note that in the same court ruling, it was also deemed that “clerical or secretarial tasks should not be billed at a paralegal rate, regardless of who performs them”[2]. Be careful not to ever bill these types of tasks, such as filing and organizing, and to only charge billable hours for tasks related directly to legal work, like legal research and writing and legal document preparation.

[cs_gb name=”inline-asset-cta-how-much-should-our-law-firm-bill-for-paralegal-work”]

What to charge

In determining the market rate, law firms should use experience, education, and geographic region to come to a final number.

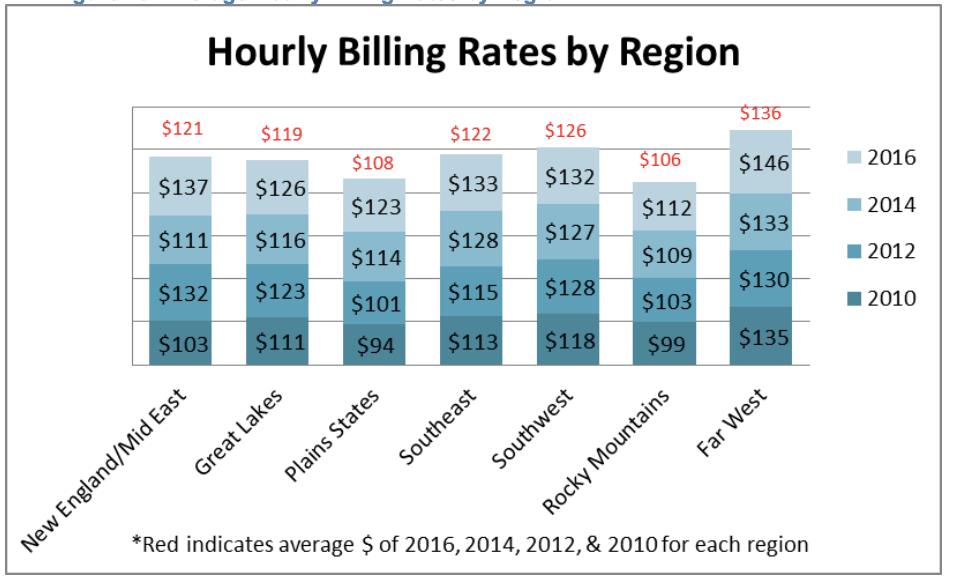

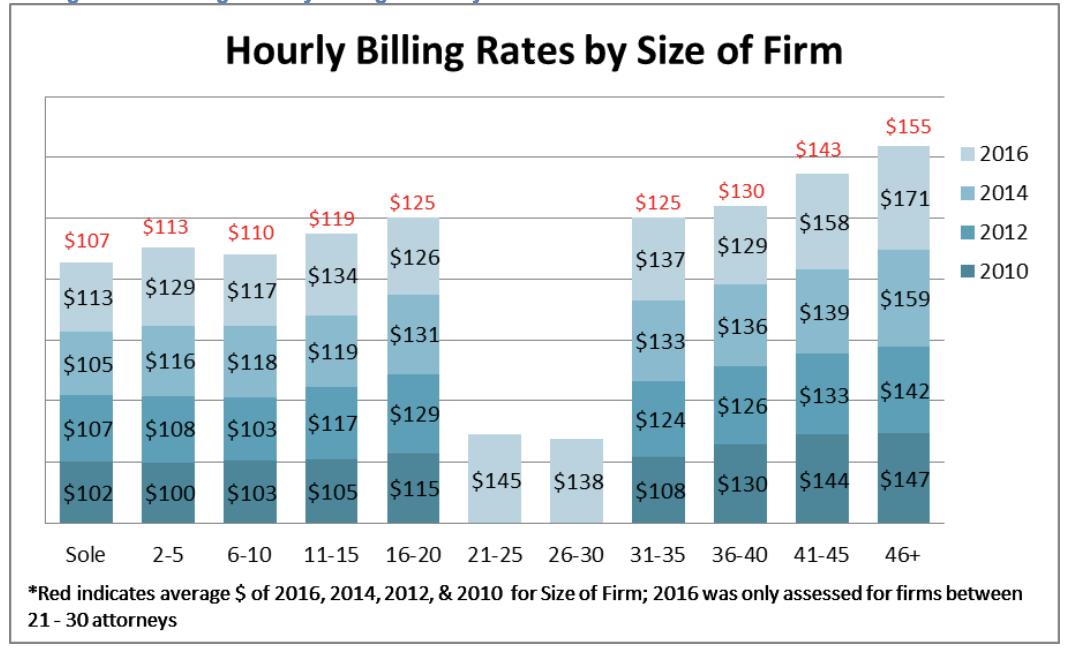

One way to check for your local billing rates is to see if your local paralegal association has any survey data. You can also utilize national organization surveys[3]. Depending on the data sources you pull from, you’ll likely see a variety of ranges. Typical paralegal billing rates fall between $100-$200 per hour, although most fall in the median of that range.

From the NALA National Compensation Survey

From the NALA National Compensation Survey

Validating charges

It’s up to your firm to be able to determine the correct amount to charge, and in doing so should be prepared to support that decision with substantiating factors. You should have available the number of years experience, certificates or certifications received and type of work performed in order to validate the charges to your clients.

It’s important that any fee statement says in detail what qualifications the paralegal has and that you’re also able to show that if the paralegal hadn’t completed the work, then an attorney would have had to do it at a higher rate.

[cs_gb name=”inline-asset-cta-how-much-should-our-law-firm-bill-for-paralegal-work”]

References

1. Missouri v. Jenkins

2. Paralegals and Billable Hour Requirements

3. National Utilization and Compensation Survey Report