What is in my law firm’s profit and loss statement?

A profit and loss statement (P&L), also known as an income statement, sets out the revenues earned and the expenses paid by a law firm during a specific period of time.[1] The statement also shows the firm’s profit, the “net income,” which is calculated by subtracting the expenses paid from the revenues earned. Since the net income appears on the bottom line of the profit and loss statement, the net income is also called the “bottom line.”

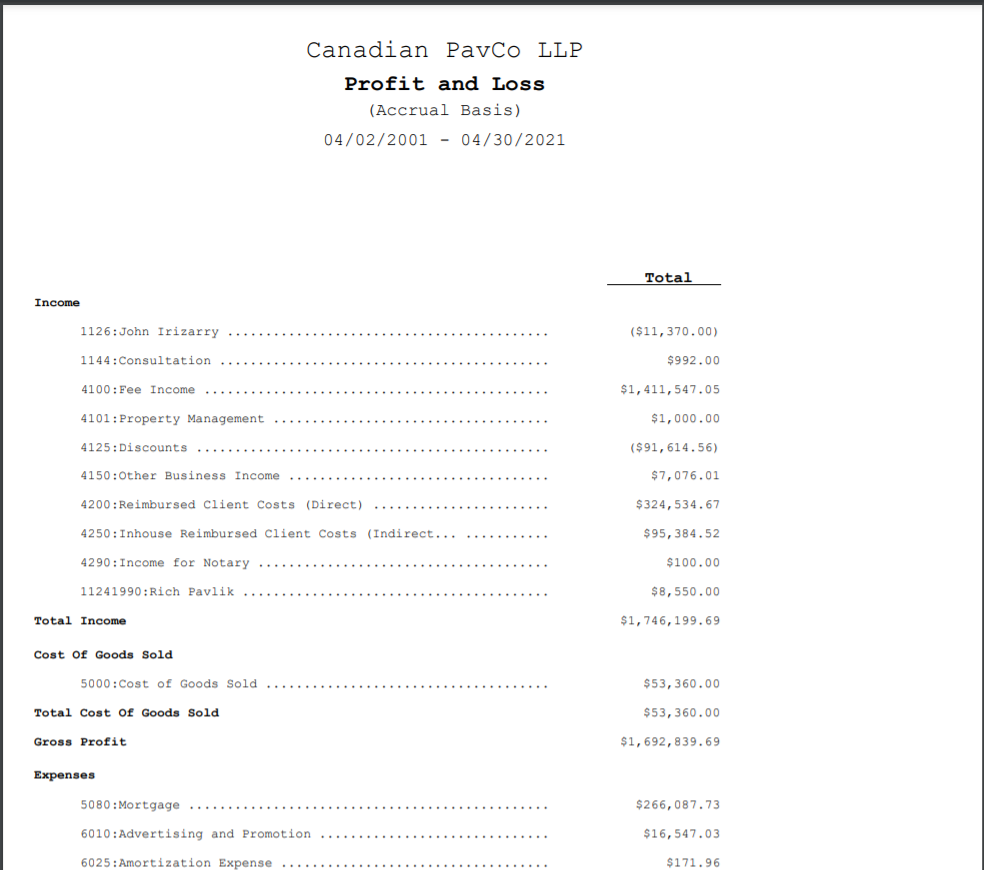

If the revenues received are greater than the expenses paid during the time period, then the net income will be a positive number which means the firm was operating “in the black,” e.g., earned a profit. The P&L for a firm that is in the black looks like this:

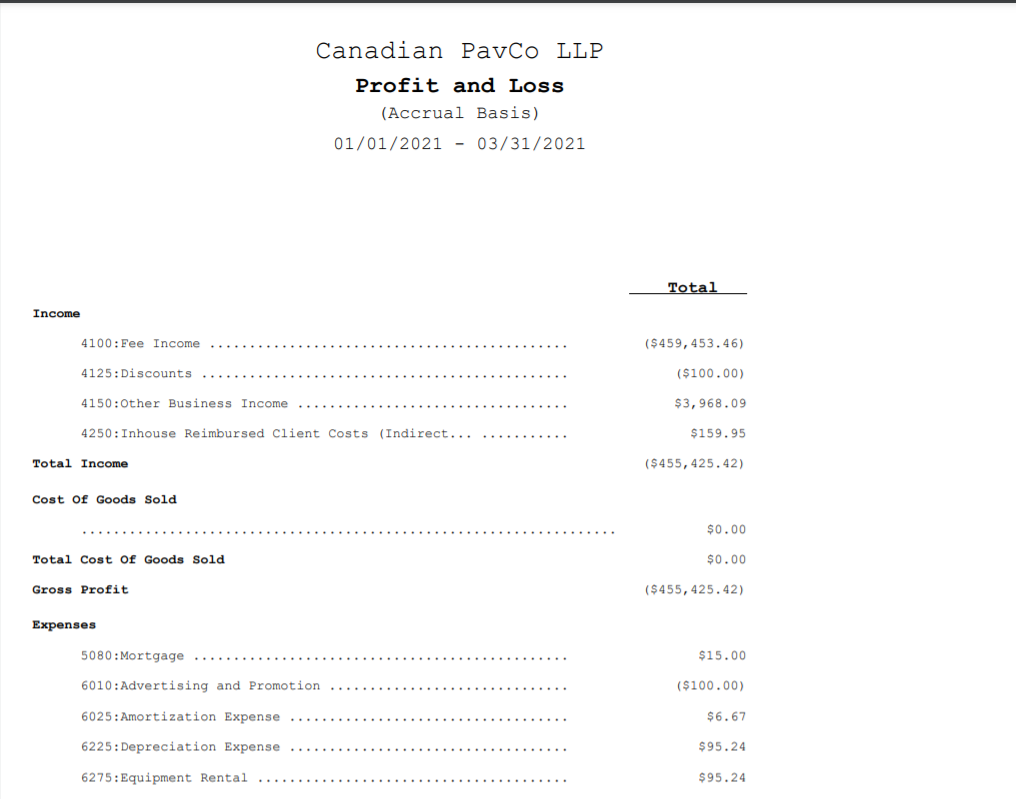

If the expenses paid are greater than the revenues during the time period, then the net income will be a negative number which means the firm was operating “in the red,” e.g., was operating at a loss. The P&L for a firm that is in the red looks like this:

Good accounting programs generate P&L statements with the push of a button once all of your company’s financial transactions have been entered and your bank account has been reconciled. As a business owner, you will want to review your P&Ls monthly to see if your revenues are sufficient and to see if your expenses are too high. If you plan on obtaining business financing, you must be able to generate a P&L as banks rely on them when deciding whether to loan money to a business.[2]

References

1. What is the profit and loss statement?

2. FindLaw – Sample Profit And Loss Statement