How do I track clients with overdue balances?

In a recent poll, small and solo attorneys named billing and collection matters as among the top three challenges in running a law firm. [1] Reports tracking clients with overdue balances, such as the aging accounts receivable report, are the starting point of all collection activities. [2] These reports allow law firms to print a list of past-due invoices for each client and matter, print a detailed list of past-due invoices by the number of days overdue (aging), or print a summary of past-due balances by client/matter and date range. How you access these reports, however, varies from accounting program to accounting program.

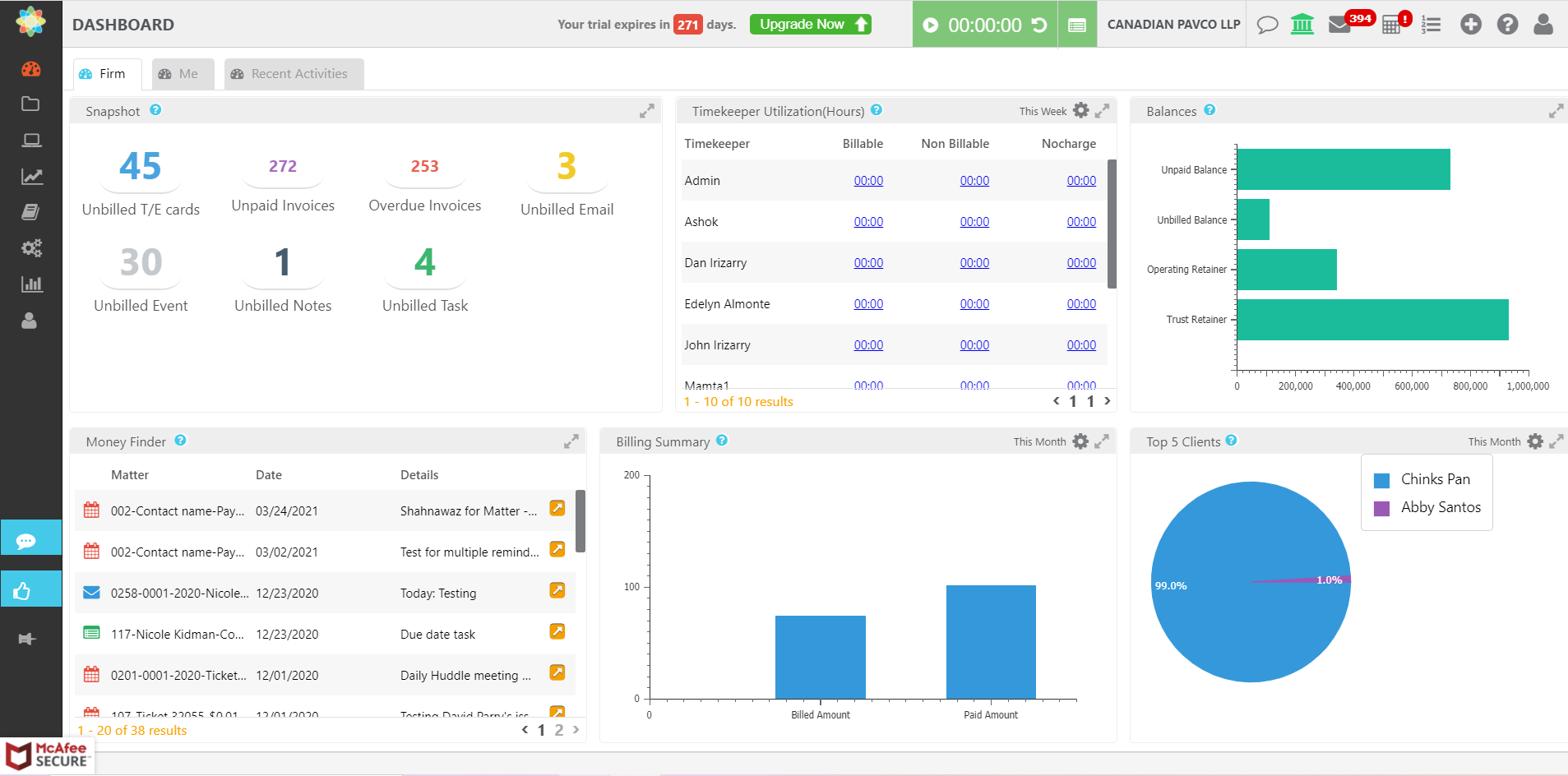

Most online accounting programs have a dashboard, which is a landing page that comes up when you log into the program.

Most dashboards show the number of past due or outstanding invoices and the total dollar amount of those invoices, and will allow you to drill down into the underlying data by clicking on the graph or chart. If the program does not have a dashboard page, it will have a report your law firm can print showing all past-due invoices. A list of past-due invoices can help your law firm with its practice management by helping you identify which specific invoices haven’t been paid and which client/matter is associated with each overdue invoice.

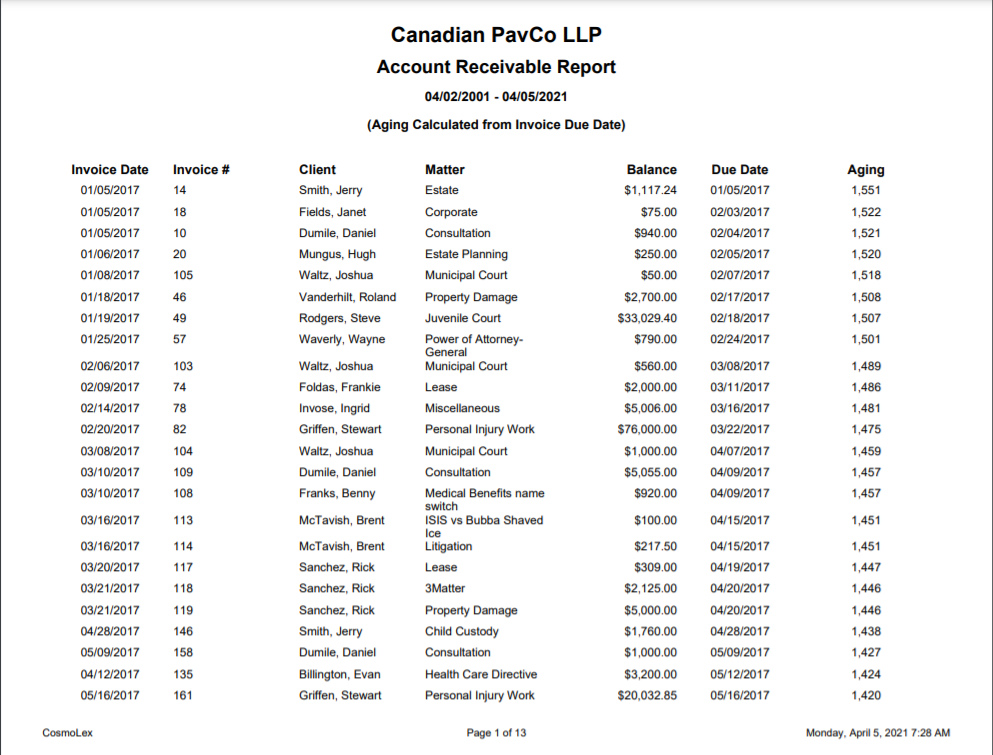

If a client/matter has multiple past-due invoices, however, a list of overdue invoices becomes less helpful because you would have to manually add up all of the client’s/matter’s overdue invoices to determine the total outstanding balance due. This is why most accounting programs have another report law firms can use to track past due balances for each client/matter – the “aging accounts receivable report” or the “accounts receivable report”

This report shows the client/matter name in the first column, and then the next columns will show what amounts are overdue in which time frame. Typically, the time frame is a 30-day window. The report looks something like this:

You read the report by looking at the client-matter and finding the columns that have amounts in them to see how far past due the amounts are. In the above example, ABC Company – Estate Planning matter has $100 past due, Bouchard, Loyd – PI matter has $800 that is more than 90 days past due, Bouchard, Loyd – Consultation matter has $110.50 31-60 days past due, etc.

This is a useful report because, at a glance, you can tell immediately which clients have significant past-due balances, and you can see how long each client’s/matter’s receivables have been on your firm’s books. This report allows your firm’s practice management team to figure out where to focus your firm’s collection activities.

If you need to know how many days overdue a specific client/matter invoice is, most accounting programs allow you to print a detailed report that lists every overdue invoice as well as the number of days the invoice is past due.

In Quickbooks, the report can group the invoices by the number of days overdue. In other programs, you may need to export the report to Excel and then do a manual sort first by the number of days overdue and second by client/matter, and then subgroup the reports by the range of days overdue.

These reports are valuable tools for law firm practice management. They help your practice management team to focus the law firm’s collection activities and determine which cases attorneys should withdraw from due to non-payment.

To learn more on how to follow up with your clients regarding to their overdue balances, see What are effective collection methods for law firms?

References

1. [Infographic] 8 Biggest Challenges of a Small Firm Lawyer

2. The accounts receivable aging